Legislative changes 2024

The coming year promises a lot of changes in the field of unemployment security. On these pages you will find information about upcoming changes and their schedules. This is the current plan for the timetable for changes. We will update the page whenever the drafting of legislation progresses. The listing has been updated 9.7.2024.

How is the drafting of legislation progressing?

Government proposals are always prepared by ministries. Statements are issued on the proposals, after which Parliament will consider in two readings, whether the amendments will be approved in two readings.

After the parliamentary process, the President confirms the Act and its entry into force.

Legislative changes 1.1.2024

No benefit is paid for the period of holiday compensation earned from full-time work. Parliament has approved the amendment.

You can read more about the periodisation of holiday compensation on our website under Right to earnings-related daily allowance, which you can access from the button below.

The waiting period will be extended from five days to seven days. Parliament has approved the amendment.

You can read more about the waiting period on our website under The amount of earnings-related allowance, which you can access from the button below.

Unemployment benefit will not increase at the turn of the year. Parliament has approved the amendment.

Government proposal HE 73/2023. Includes phasing of holiday compensation and extension of the waiting period. The parliament has approved legislative amendments.

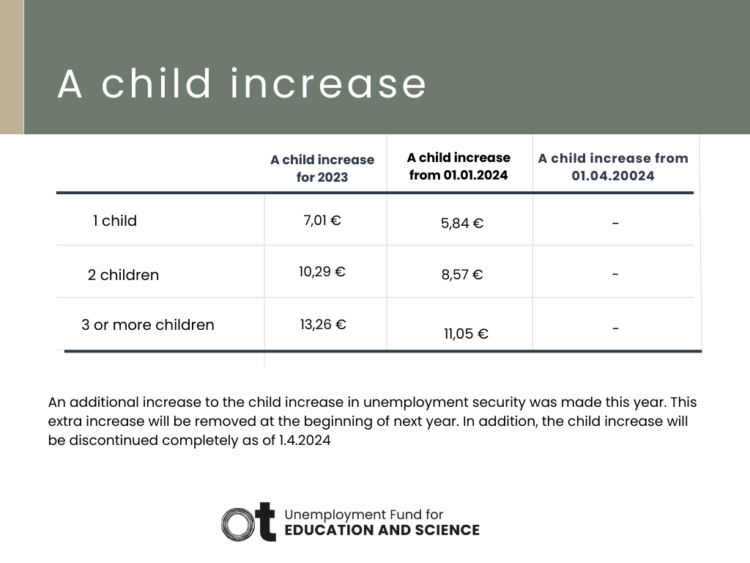

Change to the child increase during 2024

Legislative changes 1.4.2024

The child increase is paid for a maximum of three dependent children under the age of 18 (1 child €5.84/day, 2 children €8.57/day and 3 children or more €11.05/day). These increases will be removed as of 01.04.2024. Parliament has approved the amendment.

The effect on the daily allowance per month may therefore be:

- for one child approximately EUR 125.56 / month

- for two children approximately EUR 184.26 / month

- for three children or more EUR 237.58 / month

Adjusted earnings-related unemployment allowance has a standard entitlement. This means that a person’s wage income or income from part-time business activities has an impact on the amount of daily allowance only when the standard entitlement is exceeded. The standard entitlement is EUR 300 during the one-month application period and EUR 279 during the 4-week application period.

The standard entitlement will be abolished from 01.04.24. After the removal of the standard entitlement, half of the adjusted income is deducted from the earnings-related daily allowance. Parliament has approved the amendment.

Below is an example of how the abolition of the standard entitlement will affect the amount of full daily allowance.

Situation before the legislative change

Anna’s full earnings-related daily allowance is EUR 75.00 per day. Anna applies for the allowance for the period 1.3.2024 – 31.3.2024. Anna is paid a total of EUR 1000.00 part-time salary on 15.3.2024. Half of the income exceeding the standard entitlement reduces the amount of full earnings-related daily allowance, i.e.

(EUR 1000 – EUR 300) *0.5 = EUR 350.00/month reduces the amount of full daily allowance, which is EUR 350,00e / 21,5 = EUR 16,28 e / day

The amount of adjusted daily allowance will be: EUR 75.00 – EUR 16.28 = EUR 58.72/day (gross).

Situation after the legislative change

Anna has a full earnings-related daily allowance of EUR 75.00 per day. Anna applies for the allowance for the period 1.5.2024 – 31.5.2024. Anna is paid a total of EUR 1000.00 part-time salary on 15.5.2024. The standard entitlement no longer exists, so half of the adjusted income reduces the amount of full earnings-related daily allowance, i.e.

EUR 1000*0.5 = EUR500/month reduces the amount of full daily allowance, which is EUR 500.00 / 21.5 = EUR 23.26 / day

The amount of adjusted daily allowance will be: EUR 75.00 – EUR 23.26 = EUR 51.74/day (gross).

In this example, the difference is EUR 6.98/day, which makes an average of EUR 150 per month.

You can use the calculator on the website of the Federation of Unemployment Funds in Finland (TYJ) to estimate how the removal of the standard entitlement will affect your income. You can access the calculator from the link below.

Government proposal 73/2023. This includes legislative changes starting on 01.04.24, such as the abolition of child increase and the abolition of the standard entitlement. The parliament has approved legislative amendments.

Legislative changes 1.8.2024

The job alternation leave system will be abolished due to a legislative amendment.

According to the government proposal, job alternation leave could still begin on 31.7.2024. In this case, job alternation leave could continue for the entire maximum duration of 180 calendar days.

In order for job alternation leave to be considered to have started by 31.7.2024, the job alternation agreement should be submitted to the TE Office no later than 31.7.2024. The start date of the employment contract of a substitute for job alternation leave should also be 31.7.2024 at the latest.

Parliament has approved the amendment.

Government proposal 8/2024. This includes legislative changes starting on 1.8.2024 such as the abolition of job alternation leave. Parliament has approved the amendment.

Legislative changes 1.9.2024

Monetary valuation of the employment condition means that sufficient work before unemployment would in future be assessed on the basis of wages. Now entitlement to daily allowance requires a certain number of working hours over a period of 6 months.

In the euro-based employment condition, the applicant for daily allowance must have earned a certain minimum wage per month. According to the future law, this minimum wage will be EUR 930.00 per month.

The euro-based employment condition applies to wages earned and paid on or after 2.9.2024.

Parliament has approved the amendment.

Currently, earnings-related unemployment allowance is the same for the entire maximum duration. The grading of earnings-related unemployment allowance means that as a result of the legislative amendment, earnings-related unemployment allowance will decrease as follows:

- 80% after 40 benefit days (approx. 2 months)

- 75% after 170 benefit days (approx 8 months)

However, the amount of the allowance would be at least equal to the basic unemployment allowance.

According to the draft of Government proposal, the amendment would enter into force in such a way that it would not affect the daily allowance period that has already begun. The graduation would be applied when the daily allowance would be paid on the basis of work performed on or after 2.9.2024.

The parliamentary processing of the amendment is still ongoing. Please note that the content of the legislative amendment or information concerning its entry into force may change during the parliamentary process.

In future, pay-subsidised work will no longer accrue the employment condition for earnings-related daily allowance. Currently, 75% of pay-subsidised work is included in the employment condition for entitlement to earnings-related daily allowance.

The parliamentary processing of the amendment is still ongoing. Please note that the content of the legislative amendment or information concerning its entry into force may change during the parliamentary process.

Currently, working for 6 months during the membership period may entitle you to earnings-related daily allowance. In future, the allowance can be granted if you have worked for a year during the fund’s membership, i.e. the length of the employment condition doubles.

The 12-month employment condition is applied if work can be taken into account in the employment condition required for the payment of the allowance in accordance with the new euro-based model for the period of September 2024 or later.

However, the employment condition of 12 months does not apply if the employment condition has been fulfilled in work or services arranged on the basis of the employment obligation, and the work or service in question has started no later than 1.9.2024.

Parliament has approved the amendment.

Age affects several different areas of unemployment security. The Government has proposed that the following age-related exceptions to unemployment security be removed from the Act:

- people aged 57 or over may be covered by an employment obligation that guarantees them a job

- the level of daily allowance for persons over 58 or over is protected. This means that if you have turned 58 when your employment condition is met again, the salary on which earnings-related unemployment allowance is based will not be recalculated unless your salary has increased

- persons aged 60 or over can fulfil the employment condition for earnings-related unemploymet allowance in the TE Service.

According to the proposal, the protection of the level of daily allowance for persons aged 58 or over would no longer be applied if the employment condition required for the payment of daily allowance can include work in accordance with the new monetary-based model for the period of September 2024 or later.

The employment obligation ceases if the obligation began on or after 2.9.2024. The protections related to the obligation at the level of daily allowance would be applied if the work or service has been arranged on the basis of an obligation that began no later than 1.9.2024.

The parliamentary processing of the amendment is still ongoing. Please note that the content of the legislative amendment or information concerning its entry into force may change during the parliamentary process.

Government proposal 73/2023 has been processed. Concerns raising the employment condition to one year and monetary valuation of the employment condition. Government proposal 13/2024 under consideration. Concerns grading of the level of daily allowance, the abandonment of the accumulation of the employment condition for pay subsidy work and the abolition of certain age-relatex exceptions.

Other changes

The government has published a draft proposal according to which the increased component paid during employment pomotion measures be abolished as of January 1, 2025. In the future, the same daily allowance would be paid for periods of employment-promoting measures as when unemployed. The increased component of the mobility allowance would also be discontinued.

If an employment-promoting measure begins no later than June 30, 2024, the increased component could still be paid for the period of the service even after the law comes into force, in accordance with current regulations. For services that start later, payment of the increased component would end on December 31, 2024. If the service is divided into completely separate parts, there would be no entitlement to the increased component for a service starting on or after January 1, 2025.

However, these changes are still at the draft stage and preliminary, so modifications may still occur during the parliamentary process.

In the future, unemployment funds could offer their members services to promote employment. Currently, funds are not allowed to provide services that promote or support employment.

Parliament has approved the amendment HE40/2024(you move to another service)

The Government is also working to prepare a combined insurance policy for persons who are self-employed and salary earners at the same time. A universal earnings-related model is also being planned.

Addiotional materials about the topic

- HE 73 / 2023(you move to another service)

- STM063:00/2023(you move to another service)

- STM049:00/2023(you move to another service)

- HE 75/ 2023(opens in new window, you move to another service)

- HE 8/2024(opens in new window, you move to another service)

- HE 13/2024(opens in new window, you move to another service)