The amount of earnings-related allowance

The amount of allowance is calculated from your pay before unemployment. Your income will be taken into account for the calendar weeks that accumulate the 26-week employment condition.

Determination of the daily allowance

Your established taxable income, including fringe benefits, will be taken into account in the calculation of the allowance. Your income will be reduced by the holiday bonus and holiday compensation as well as the annual rate of unemployment and pension insurance (3,76 % in 2024).

You can find a more detailed table on earnings-related allowances on the website of the Federation of Unemployment Funds in Finland (TYJ) at www.tyj.fi.(you move to another service) There is also an allowance calculator in Openetti(opens in new window, you move to another service) and also on our website. You can use the calculator to estimate the amount of your daily allowance.

Earnings-related allowances are taxable income(you move to another service) and are paid for five days a week.

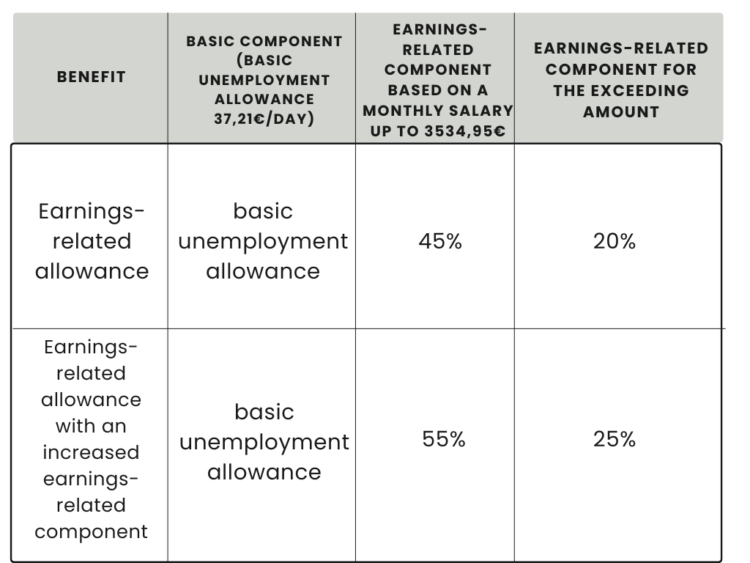

The allowance paid by the fund consists of a basic component, which equals the basic unemployment allowance (EUR 37,21 per day in 2024), and an earnings-based component as follows:

A child increase is paid for a maximum of three children in your care that are under the age of 18 years

- 1 child EUR 7.01/day (until 31.12.23), 5,84 € /day from 01.01.2024

- 2 children EUR 10.29/day (until 31.12.23), 8,57 € /day from 01.01.2024

- 3 children or more EUR 13.26/day (until 31.12.23), 11,05 € /day from 01.01.2024

The full earnings-related allowance, including child increases, may not exceed 90% of the daily pay on which the allowance is based or, at least, equal the amount of the basic unemployment allowance increased by the amount of any child increase.

Examples of earnings-related allowance calculation

Example 1.

Monthly salary does not exceed 3,534.95 €/month (164.42 €/day)

Monthly salary 2573,00 €

1. Reduced by 3.76%: 2573.00€ – (0.0376 * 2573.00€) = 2476,26€

2. Daily pay: 2476.26€ / 21.5 = 115.17 €/day

3. Allowance: 37.21€ + 0.45 * (115.17€ – 37.21€) = 72.29 €/day

4. Allowance per month: 21.5 * 72.29€/day = 1554,24 €/month

Example 2.

Monthly salary exceeds 3,534.95 €/month (164.42 €/day)

Monthly salary 3700.00€

1. Reduced by 3,76%: 3700.00€ – (0.0376 * 3700.00€) = 3560.88€

2. Daily pay: 3560.88€ / 21.5 = 165.62 €/day

3. Allowance: 37.21€ + 0.45 * (164.42€ – 37.21€) + 0.20 * (165.62 € – 164.42€) = 94.69 €/day

4. Allowance per month: 21.5 * 94.69€/day = 2035.84 €/month

Exceptions to the calculation of daily allowance

- Partial penson: If you have received a partial disability or part-time pension, the pay on which your allowance is based is determined on the basis of the period before the payment of your pension began, even if the employment condition was fulfilled during your retirement.

- Job alternation leave or partial child-care leave: If you have been on job alternation leave or partial child-care leave and you have not been employed for at least 26 weeks after the end of the leave, your allowance is determined on the basis of the wages you received before the leave began.

- Pay-subsidised work: Only 75% of pay-subsidised work accumulates the employment condition. Time that cannot be counted in the employment condition extends the review period. However, each week of pay-subsidised employment will still accumulate the employment condition in cases in which a municipality has been obligated to employ a person. The Employment and Economic Development Office investigates the conditions for pay-subsidised employment.

Reviewing the amount of daily allowance

The amount of earnings-related allowance is reviewed when the 26-week employment condition is fulfilled. This means that the amount of the allowance may increase or decrease. The new amount of allowance is calculated even if there are unpaid days remaining in the previous allowance period. However, the recalculation usually takes place no more than once a year.

If your maximum payment period is not exhausted before your employment condition is re-fulfilled, your new earnings-related allowance will be at least 80% of the previously paid earnings-related allowance.

When is the amount of the allowance recalculated?

- The amount of your earnings-related allowance is recalculated if you re-fulfil the employment condition so that the first payment date following the fulfilment of the new employment condition is later than one year after the date of the first allowance payment.

- The amount of your earnings-related allowance is also recalculated if you have re-fulfilled the employment condition in such a way that the amount of the allowance was not calculated when the employment condition was last met. In this case, it makes no difference whether or not the new first payment date is within one year of the previous first payment date.

When is the amount of the allowance not recalculated even if the employment condition is met?

The amount of your earnings-related allowance will not change if you re-fulfil the employment condition so that the first possible payment date following the fulfilment of the new employment condition is within a year of the previous first allowance day, and the allowance was determined at the time.

Protecting the amount of earnings-related allowance for 58-year-olds

If you have reached 58 years when your employment condition is re-fulfilled, the pay which your earnings-related allowance is based on will not be recalculated unless your pay has risen.

Increased daily allowance

You may receive an increased earnings-related allowance if you participate in an employment promotion measure. You are eligible for an increased earnings-related component for a maximum of 200 days during your participation in the measure. The payment of an increased earnings-related component requires that the measure was agreed with the TE Office and included in your re-employment plan.

Further information: Employment promotion measures(you move to another service).

Waiting period

When you apply for the allowance, you may be subject to a waiting period. The waiting period equals seven weekdays of unemployment, for which no daily allowance is paid. In 2023, the waiting period corresponded to five days.The waiting period must be met in 8 consecutive calendar weeks.

For example, if you work every day for 50% of the hours of a full-time employee, it will take 14 days for your waiting period to be spent. During a suspension period, no waiting period can be applied.

The waiting period is set by the unemployment fund (compare: the TE Office decides on suspension periods). If you participate in an employment promotion measure arranged by the TE Office, the earnings-related allowance can be paid during the waiting period. A waiting period may also be applied when you meet the employment condition again..

Setting the waiting period

The waiting period is set when:

- you become unemployed for the first time, or

- you re-fulfil the employment condition before you have received an allowance for even a single day after the previous waiting period, or

- you re-fulfil the employment condition within a year from the start of the payment of your allowance, but no waiting period was set when your employment condition was last met, or

- you re-fulfil the employment condition more than a year after your allowance payment began.

Example 1

Person A is unemployed in summer 2021, the first day of unemployment is 7.6.2021. A has been set to have a waiting period for the period 7.6.2021 – 13.6.2021 and the first paid day of the daily allowance period has been 14.6.2021.

In the autumn, A will start a new fixed-term employment relationship which will end on 30.6.2022. A applies for the daily allowance starting from 1.7.2022. The waiting period is set because the new employment condition is met within more than one year from the first payment day of the previous daily allowance period.

Example 2

Person A is unemployed for the period 7.6.2021 – 13.6.2021. The new fixed-term full-time job is during the period 14.6.2021 – 31.5.2022. A applies for the daily allowance for the period 7.6.2021 – 13.6.2021. A is unemployed only for the duration of the waiting period , so A does not receive any daily allowance,

A will again apply for the daily allowance starting from 1.6.2022, and the employment condition is met again. Even thouhg it’s less than a year since the previous waiting period was set, the waiting period is now set again as the employment condition has been met again before it has been possible to pay a daily allowance for any day after the previous waiting period.

Example 3

Person A has become unemployed for the first time on 1.6.2020. The waiting period is set for the period 1.6.2020 – 7.6.2020, and the first day to be paid has been 8.6.2020.

In autumn 2020, A will start a new fixed-term employment relationship that will end on 30.5.2021, so the first day of unemployment is 31.5.2021. Now, the new employment condition is met and the new maximum payment period starts within one year of the start of the previous maximum payment period, so no waiting period is set.

In autumn 2021, A will start a new fixed-term employment relationship which will end on 30.4.2022 and the first day of unemployment will be 1.5.2022. Although the new employment condition will be met again within one year of the start of the previous maximum payment period, a waiting period will be set. This is because when the employment condition was met last time, no waiting period was set.

When is the waiting period not set?

A waiting period will not be set, if you have fulfilled the employment condition (26 weeks) again and the new maximum payment period for an earnings-related allowance (300, 400 or 500-day maximum) will start within a year from the start of the previous maximum period and the waiting period was set for you at that time.

Person A is unemployed in summer 2021, the first day of unemployment is 7.6.2021. A has been set to have a waiting period for the period 7.6.2021 – 13.6.2021, and the first paid day of the daily allowance period has been 14.6.2021.

In the autumn, A will start a fixed-term employment relationship, which will end on 31.5.2022. A applies for the daily allowance starting from 1.6.2022. The waiting period is not set, as the employment condition is met and the new daily allowance maximum period satrts within one year of the start of the previous maximum payment period.

Taxation of benefits

Earnings-related allowance, job alternation compensation and mobility allowance are taxable income. The Tax Administration provides the fund with our members’ salary withholding tax information from 1 February. You do not need to send the tax card you receive at home to the fund. If you have joined the fund in the middle of the year, please check the ‘Personal information’ section of Openetti to make sure that we have received your tax information.

We use your salary withholding tax rate in the payment of the benefit. However, the percentage is at least 25%, even if your tax rate is lower.

If you wish, you can order a revised tax card for benefits, and the tax will be withheld according to the rate on this tax card.You can order a revised tax card for benefits in the online tax service MyTax. In the service, select ‘Unemployment Fund for Education and Science’ as the payer of the benefit, and your tax card information will be automatically received by the fund, usually on the next working day at the earliest.

More information on taxation is available on the website of the Tax Administration at www.vero.fi(opens in new window, you move to another service).

Currently, if a person does not have a valid tax card for benefits the Tax Administration automatically reports the withholding tax rate as 25 percent. Previously, the information reported by the Tax Administration was always the same as the information indicated on the tax card, but tax was withheld at a rate of 25 percent when using a tax card intended for wages.

The Tax Administration reports the annual income threshold to the unemployment fund by sending an estimate of the income threshold for your earnings-related daily allowance. The estimate is based on the estimated earnings indicated on your tax card, and earnings-related daily allowance is generally approximately 60 percent of your earnings.

This new practice related to the transfer of tax information was introduced by the Tax Administration and information about the practice and other matters related to taxation is available at www.vero.fi.