Legislative changes 2024 – 2025

The coming year promises a lot of changes in the field of unemployment security. On these pages you will find information about upcoming changes and their schedules. This is the current plan for the timetable for changes. We will update the page whenever the drafting of legislation progresses. The listing has been updated 30.9.2024.

How is the drafting of legislation progressing?

Government proposals are always prepared by ministries. Statements are issued on the proposals, after which Parliament will consider in two readings, whether the amendments will be approved in two readings.

After the parliamentary process, the President confirms the Act and its entry into force.

Legislative changes 1.1.2024

No benefit is paid for the period of holiday compensation earned from full-time work. Parliament has approved the amendment.

You can read more about the periodisation of holiday compensation on our website under Right to earnings-related daily allowance, which you can access from the button below.

The waiting period will be extended from five days to seven days. Parliament has approved the amendment.

You can read more about the waiting period on our website under The amount of earnings-related allowance, which you can access from the button below.

Unemployment benefit will not increase at the turn of the year. Parliament has approved the amendment.

Government proposal HE 73/2023. Includes phasing of holiday compensation and extension of the waiting period. The parliament has approved legislative amendments.

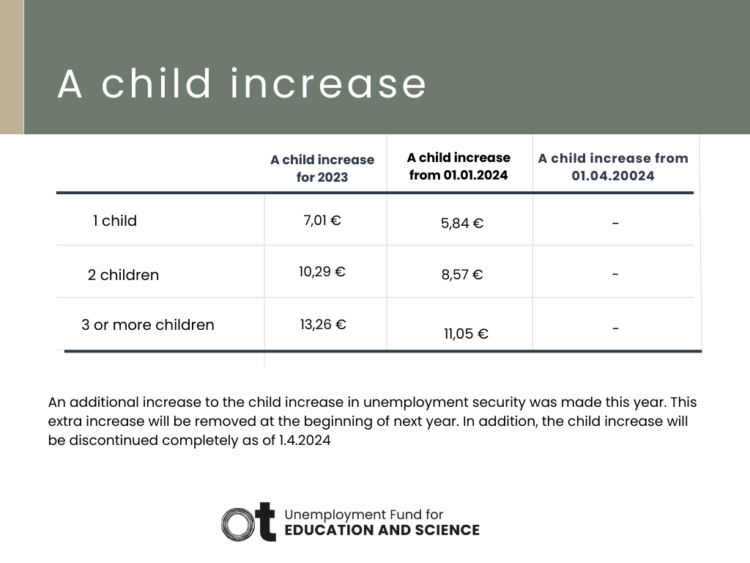

Change to the child increase during 2024

Legislative changes 1.4.2024

The child increase is paid until March 31, 2024, for a maximum of three dependent children under the age of 18 (1 child €5.84/day, 2 children €8.57/day and 3 children or more €11.05/day). These increases will be removed as of 01.04.2024. Parliament has approved the amendment.

The effect on the daily allowance per month may therefore be:

- for one child approximately EUR 125.56 / month

- for two children approximately EUR 184.26 / month

- for three children or more EUR 237.58 / month

Until March 31, 2024, adjusted earnings-related unemployment allowance has a standard entitlement. This means that a person’s wage income or income from part-time business activities has an impact on the amount of daily allowance only when the standard entitlement is exceeded. The standard entitlement is EUR 300 during the one-month application period and EUR 279 during the 4-week application period.

The standard entitlement will be abolished from 01.04.24. After the removal of the standard entitlement, half of the adjusted income is deducted from the earnings-related daily allowance. Parliament has approved the amendment.

Below is an example of how the abolition of the standard entitlement will affect the amount of full daily allowance.

Situation before the legislative change

Anna’s full earnings-related daily allowance is EUR 75.00 per day. Anna applies for the allowance for the period 1.3.2024 – 31.3.2024. Anna is paid a total of EUR 1000.00 part-time salary on 15.3.2024. Half of the income exceeding the standard entitlement reduces the amount of full earnings-related daily allowance, i.e.

(EUR 1000 – EUR 300) *0.5 = EUR 350.00/month reduces the amount of full daily allowance, which is EUR 350,00e / 21,5 = EUR 16,28 e / day

The amount of adjusted daily allowance will be: EUR 75.00 – EUR 16.28 = EUR 58.72/day (gross).

Situation after the legislative change

Anna has a full earnings-related daily allowance of EUR 75.00 per day. Anna applies for the allowance for the period 1.5.2024 – 31.5.2024. Anna is paid a total of EUR 1000.00 part-time salary on 15.5.2024. The standard entitlement no longer exists, so half of the adjusted income reduces the amount of full earnings-related daily allowance, i.e.

EUR 1000*0.5 = EUR500/month reduces the amount of full daily allowance, which is EUR 500.00 / 21.5 = EUR 23.26 / day

The amount of adjusted daily allowance will be: EUR 75.00 – EUR 23.26 = EUR 51.74/day (gross).

In this example, the difference is EUR 6.98/day, which makes an average of EUR 150 per month.

You can use the calculator on the website of the Federation of Unemployment Funds in Finland (TYJ) to estimate how the removal of the standard entitlement will affect your income. You can access the calculator from the link below.

Government proposal 73/2023. This includes legislative changes starting on 01.04.24, such as the abolition of child increase and the abolition of the standard entitlement. The parliament has approved legislative amendments.

Legislative changes 1.8.2024

The job alternation leave system will be abolished due to a legislative amendment.

According to the government proposal, job alternation leave could still begin on 31.7.2024. In this case, job alternation leave could continue for the entire maximum duration of 180 calendar days.

In order for job alternation leave to be considered to have started by 31.7.2024, the job alternation agreement should be submitted to the employment authorities no later than 31.7.2024. The start date of the employment contract of a substitute for job alternation leave should also be 31.7.2024 at the latest.

Parliament has approved the amendment.

Government proposal 8/2024. This includes legislative changes starting on 1.8.2024 such as the abolition of job alternation leave. Parliament has approved the amendment.

Legislative changes 1.9.2024

Monetary valuation of the employment condition means that, starting from 2.9.2024, sufficient work before unemployment is assessed on the basis of wages. Until 1.9.2024, entitlement to daily allowance requires a certain number of working hours over a period of 6 months.

In the euro-based employment condition, the applicant for daily allowance must have earned a certain minimum wage per month. According to the new law, this minimum wage is EUR 930.00 per month.

The employment condition can also accumulate in half-months. If the salary paid during a calendar month is less than €930.00 but at least €465.00, you will accumulate half of a month towards the employment condition. Two half-months equal one full month for the employment condition. Therefore, entitlement to earnings-related unemployment benefits can be accumulated, for example, from 8 full months and 8 half-months. The half-months do not need to be consecutive.

The euro-based employment condition will apply to wages earned and paid on or after September 2, 2024.

NOTE! Although the employment condition will accumulate based on the salary paid for work rather than the number of hours worked, the hours worked during the application period must still be reported on the application form, at least for now!

The Parliament has approved the legislative amendment.

You can read more about the employment condition on our website under the section ‘Right to earnings-related daily allowance,’ accessible via the button below.”

Currently, earnings-related unemployment allowance is the same for the entire maximum duration. The grading of earnings-related unemployment allowance means that as a result of the legislative amendment, earnings-related unemployment allowance will decrease as follows:

- 80% after 40 benefit days (approx. 2 months)

- 75% after 170 benefit days (approx 8 months)

However, the amount of the allowance would be at least equal to the basic unemployment allowance.

The amendment will come into effect in such a way that it does not affect benefit periods that have already started. The graduation will be applied when unemployment benefits are paid based on work done on or after September 2, 2024.”

Parliament has approved the amendment.

You can estimate the amount of earnings-related unemployment benefits after the graduated system is applied using the calculator available on the website of the Federation of Unemployment Funds in Finland (TYJ):

Pay-subsidised work will no longer count towards the employment condition for earnings-related unemployment benefits, with a few exceptions. Before the legislative amendment, 75% of pay-subsidised work was considered for the employment condition to qualify for earnings-related unemployment benefits.

The Parliament has approved the legislative amendment.

Read more about pay-subsidized employment on our website:

Until September 1, 2024, 26 weeks of employment during the membership period may entitle you to earnings-related daily allowance. Starting from September 2, 2024, the allowance can be granted if you have worked for a year during the fund’s membership, i.e. the length of the employment condition doubles.

The employment condition of 12 clendar months is applied if work can be taken into account in the employment condition required for the payment of the allowance in accordance with the new euro-based model for the period of September 2024 or later.

However, the employment condition of 12 calendar months does not apply if the employment condition has been fulfilled in work or services arranged on the basis of the employment obligation, and the work or service in question has started no later than 1.9.2024.

Parliament has approved the amendment.

Age affects several different areas of unemployment security. The following age-related exceptions from unemployment security have been removed from the law:

- people aged 57 or over may be covered by an employment obligation that guarantees them a job

- the level of daily allowance for persons over 58 or over is protected. This means that if you have turned 58 when your employment condition is met again, the salary on which earnings-related unemployment allowance is based will not be recalculated unless your salary has increased

- persons aged 60 or over can fulfil the employment condition for earnings-related unemploymet allowance in the TE Service.

The protection of the benefit level for those over 58 years old will no longer apply if the employment condition required for the payment of earnings-related unemployment benefits can include work based on the new euroised model from September 2024 or later.

The employment obligation will cease if the obligation would begin on or after September 2, 2024. Protections related to the benefit level will apply if the work or service was arranged based on an obligation that started no later than September 1, 2024.

The Parliament has approved the legislative amendment.

Government proposal 73/2023 has been processed. Concerns raising the employment condition to one year and monetary valuation of the employment condition. Government proposal 13/2024 under consideration. Concerns grading of the level of daily allowance, the abandonment of the accumulation of the employment condition for pay subsidy work and the abolition of certain age-relatex exceptions.

Legislative changes 1.1.2025

According to the government’s proposal, the increased component for employment promotion measures would be discontinued from January 1, 2025. Going forward, the same benefit will be paid during the time spent in employment promotion measures as when unemployed. The increased component for mobility allowance would also be eliminated.

If the employment promotion measure starts no later than December 31, 2024, the increased component could still be provided for the duration of the measure even after the law comes into effect, according to the current regulations. However, if the measure is divided into completely separate parts, there would be no entitlement to the increased component for service parts starting on January 1, 2025, or later.

These changes are still preliminary, so amendments may occur during parliamentary processing. We will provide more information as soon as we receive further details.

Read the news article on our website about this topic:

Government proposal HE 135/2024(you move to another service) is under consideration. Concerns the removal of increased component for earnings-related daily allowance and mobility allowance.

Other changes

In the future, unemployment funds could offer their members services to promote employment. Currently, funds are not allowed to provide services that promote or support employment.

Parliament has approved the amendment HE40/2024(you move to another service)

The Government is also working to prepare a combined insurance policy for persons who are self-employed and salary earners at the same time. A universal earnings-related model is also being planned.

Addiotional materials about the topic

- HE 73 / 2023(you move to another service)

- STM063:00/2023(you move to another service)

- STM049:00/2023(you move to another service)

- HE 75/ 2023(opens in new window, you move to another service)

- HE 8/2024(opens in new window, you move to another service)

- HE 13/2024(opens in new window, you move to another service)

- HE 135/2024(you move to another service)